Moving Averages Strategy: In the vast landscape of Forex trading, mastering various strategies is essential for navigating the complexities of the market. One widely employed and versatile tool in a trader’s arsenal is the moving average. This guide explores the world of moving averages strategies for Forex, providing an in-depth understanding of how these indicators can be leveraged to enhance decision-making and boost trading performance.

Chapter 1: Understanding Moving Averages

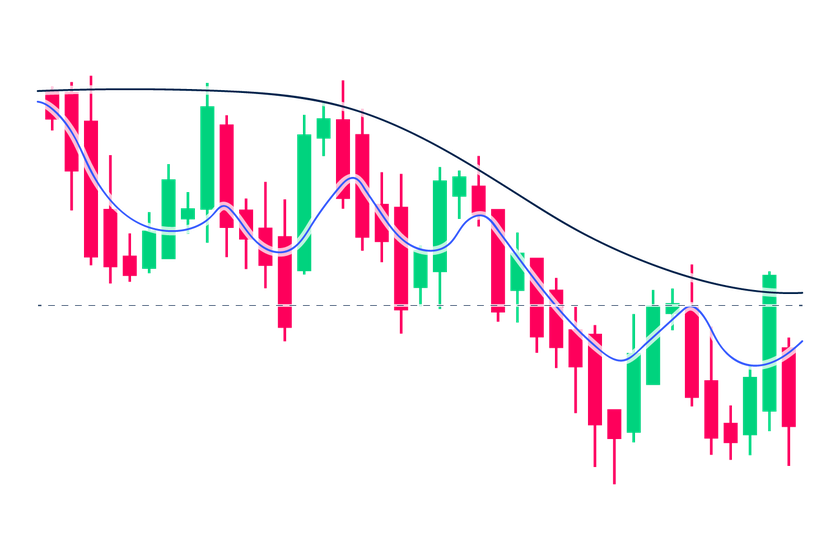

To embark on a journey of moving averages strategies, it is imperative to comprehend the fundamentals of these indicators. Moving averages are statistical calculations that smooth out price data to create a single flowing line. Traders primarily use two types: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA gives equal weight to all data points, while the EMA places greater emphasis on recent prices. This chapter introduces these concepts, laying the groundwork for more advanced strategies.

Chapter 2: Trend Identification with Moving Averages

One of the primary applications of moving averages in Forex trading is trend identification. Traders use moving averages to assess the general direction of the market. This chapter explores how to interpret the position of price in relation to the moving average line. Crossovers, where the price crosses above or below the moving average, serve as signals for potential trend changes. Understanding the significance of moving average crossovers is crucial for traders aiming to ride trends and avoid false signals.

Chapter 3: Moving Average Timeframes

The choice of timeframe plays a pivotal role in the effectiveness of moving averages. This chapter delves into the impact of different timeframes on the interpretation of moving averages. Short-term moving averages, such as the 10-day or 20-day EMA, are more responsive to recent price changes, making them suitable for capturing short-term trends. In contrast, long-term moving averages, like the 50-day or 200-day SMA, provide a broader perspective and are instrumental in identifying the overall market direction.

Chapter 4: Dual Moving Average Strategies

One popular moving averages strategy involves using two moving averages with different timeframes. This chapter explores the concept of dual moving average crossovers. For instance, a trader might use a short-term EMA and a long-term SMA. A buy signal is generated when the short-term EMA crosses above the long-term SMA, indicating potential upward momentum. Conversely, a sell signal occurs when the short-term EMA crosses below the long-term SMA, signaling a potential downtrend. Understanding how to choose appropriate timeframes for dual moving average strategies is vital for successful implementation.

Chapter 5: Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a powerful indicator that combines two moving averages with a histogram. This chapter delves into the intricacies of the MACD, exploring its components and interpretation. Traders use the MACD to identify potential changes in trend momentum. Crossovers between the MACD line and the signal line, as well as the movement of the histogram above or below the zero line, serve as signals for buying or selling opportunities.

Chapter 6: Support and Resistance with Moving Averages

Moving averages also play a crucial role in identifying support and resistance levels. This chapter explores how moving averages act as dynamic support or resistance, providing traders with valuable insights into potential price reversals. Understanding how to incorporate moving averages into a broader support and resistance analysis enhances a trader’s ability to make well-informed decisions in the market.

Chapter 7: Moving Averages in Range-Bound Markets

While moving averages are often associated with trend identification, they can also be valuable in range-bound markets. This chapter discusses strategies for using moving averages to trade within established price ranges. Traders can identify potential reversal points by observing how price interacts with moving averages in a sideways market, allowing for profitable opportunities even when the market lacks a clear trend.

Chapter 8: Risk Management and Moving Averages

No trading strategy is complete without a robust risk management plan. This chapter explores how traders can integrate moving averages into their risk management strategies. Setting stop-loss orders based on moving average levels and adjusting position sizes according to market conditions are essential aspects of risk management when employing moving averages strategies.

Conclusion:

Mastering moving averages strategies for Forex trading requires a comprehensive understanding of the indicators’ nuances and their application in diverse market conditions. From trend identification to support and resistance analysis, moving averages offer traders a versatile set of tools for making informed decisions. By delving into the intricacies of dual moving averages, MACD, and risk management techniques, traders can elevate their proficiency in navigating the dynamic Forex market. As with any trading strategy, continuous learning, practice, and adaptability are key to success in implementing moving averages strategies effectively.

External references:

- https://www.investopedia.com/ask/answers/122314/how-do-i-use-moving-average-ma-create-forex-trading-strategy.asp

- https://www.babypips.com/learn/forex/silky-smooth-moving-averages

- https://www.oanda.com/bvi-en/cfds/learn/indicators-oscillators/filtering-out-the-noise-moving-averages/

- https://en.wikipedia.org/wiki/Moving_average