In the dynamic world of forex trading, a spread strategy is a versatile approach used by traders to capitalize on the price differentials between currency pairs. The forex market, characterized by its high liquidity and constant price fluctuations, offers ample opportunities for traders to implement various spread strategies. This comprehensive guide aims to delve into the intricacies of spread strategies in forex trading, providing traders with a solid understanding of the concept, types of spreads, and effective implementation techniques.

I. Understanding Forex Spreads:

A. Definition of Spread:

In forex trading, the spread refers to the difference between the bid (selling) and ask (buying) prices of a currency pair. This difference represents the transaction cost for traders and is typically measured in pips. A narrower spread implies lower transaction costs, while a wider spread can increase trading costs.

B. Types of Spreads:

- Fixed Spreads: Some brokers offer fixed spreads, where the difference between the bid and ask prices remains constant under normal market conditions. This provides traders with transparency and predictability in terms of transaction costs.

- Variable Spreads: Variable spreads fluctuate based on market conditions. During periods of high volatility, variable spreads tend to widen, reflecting the increased risk and potential market uncertainty.

II. Common Spread Strategies:

A. Arbitrage:

- Triangular Arbitrage: Traders exploit price discrepancies between three different currency pairs. For example, if the cross rates derived from major pairs do not align, a trader can execute trades to capitalize on the misalignment and secure a profit.

- Statistical Arbitrage: This strategy involves using statistical models to identify deviations from historical price relationships between currency pairs. Traders seek to profit from mean reversion when prices deviate from their expected values.

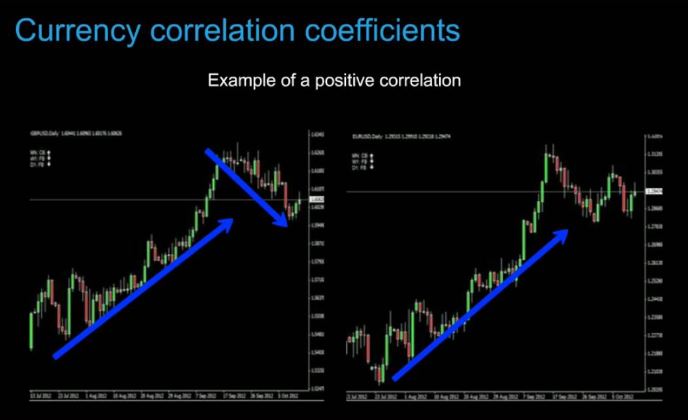

B. Pairs Trading:

- Correlation-Based Pairs Trading: Traders identify currency pairs that historically exhibit a strong correlation. When the correlation weakens, traders go long on the underperforming currency and short the outperforming one, expecting a reversion to the mean.

- Cointegration-Based Pairs Trading: Similar to correlation trading, cointegration focuses on pairs that have a long-term statistical relationship. Traders take advantage of temporary divergences by going long on the undervalued currency and short on the overvalued one.

III. Implementing Spread Strategies Effectively:

A. Risk Management:

- Position Sizing: Traders need to determine the appropriate size for their positions based on the level of risk they are willing to take. This involves considering the size of the trading account, the volatility of the currency pairs, and the desired risk-reward ratio.

- Stop-Loss Orders: To mitigate potential losses, traders should set stop-loss orders at strategic levels. This helps enforce discipline and prevents emotional decision-making during periods of market turbulence.

B. Market Conditions and Timing:

- Volatility Considerations: Traders must be mindful of market volatility, as it directly influences spreads. During high-volatility periods, spreads can widen, impacting the cost-effectiveness of certain strategies.

- News and Economic Events: Events such as economic releases, geopolitical developments, and central bank announcements can significantly affect currency pairs and spreads. Traders should be aware of the economic calendar and exercise caution during such events.

C. Technology and Platforms:

- Execution Speed: In the fast-paced forex market, the speed of trade execution is crucial. Traders should choose brokers and trading platforms that offer fast and reliable order execution to ensure the timely implementation of spread strategies.

- Analytical Tools: Utilizing technical and fundamental analysis tools can enhance a trader’s ability to identify potential opportunities and risks associated with spread strategies.

IV. Challenges and Risks:

A. Liquidity Risk: Some currency pairs may have lower liquidity, leading to wider spreads. Traders need to be cautious when dealing with illiquid pairs to avoid slippage and increased transaction costs.

B. Market Impact: Large trades can impact the market and cause slippage, especially in less liquid currency pairs. Traders should be mindful of the potential market impact of their orders.

C. Over-Optimization: While backtesting is essential, over-optimizing a spread strategy based on historical data may lead to poor performance in real-time markets. Traders should strike a balance between historical analysis and adapting to current market conditions.

Conclusion:

Mastering spread strategies in forex trading requires a combination of technical expertise, risk management skills, and a deep understanding of market dynamics. Traders can leverage the various types of spreads and implement strategies such as arbitrage and pairs trading to capitalize on price differentials. However, it is crucial to remain vigilant, adapt to changing market conditions, and continually refine strategies to stay ahead in the dynamic and ever-evolving forex market. As with any trading approach, thorough research, disciplined execution, and prudent risk management are key to achieving long-term success with spread strategies in the forex market.