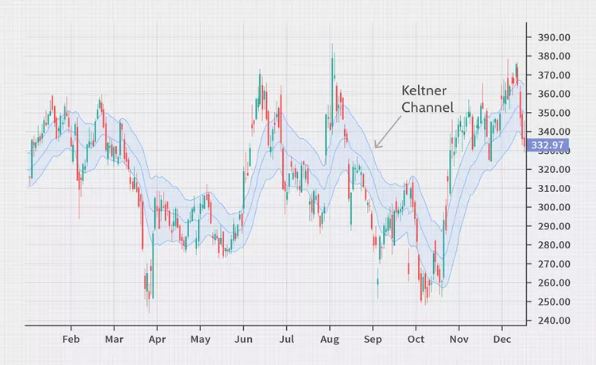

The Keltner Channel Strategy, developed by Chester W. Keltner in the 1960s, is a technical analysis tool used by traders to identify potential trends and reversals in financial markets. Named after its creator, the Keltner Channel is a versatile indicator that can be applied to various financial instruments, including stocks, commodities, and currencies. This comprehensive guide aims to provide traders with a thorough understanding of the Keltner Channel Trading System, its components, and its application in the dynamic world of trading.

I. Keltner Channels: An Overview

A. Construction of Keltner Channels:

The Keltner Channel consists of three key components:

- Exponential Moving Average (EMA): The centerline of the channel is typically a 20-period EMA, representing the average price over the specified time frame.

- Upper Channel Line: The upper channel line is constructed by adding a multiple of the Average True Range (ATR) to the EMA. The multiplier is a user-defined parameter, allowing traders to adjust the sensitivity of the channel.

- Lower Channel Line: Similar to the upper channel line, the lower channel line is formed by subtracting a multiple of the ATR from the EMA.

B. Understanding Average True Range (ATR):

ATR is a volatility indicator that measures the average price range over a specified period. In the Keltner Channel Trading System, ATR is used to define the width of the channel, reflecting market volatility. Higher ATR values result in wider channels, indicating increased volatility, while lower ATR values produce narrower channels, signifying reduced volatility.

II. Trading Signals with Keltner Channels

A. Trend Identification:

- Channel Width and Trend Strength: The width of the Keltner Channel provides insights into the strength of the prevailing trend. Wider channels suggest a more robust trend, while narrower channels may indicate a weakening trend or potential reversal.

- Price Action in Relation to the Channel: Traders look for price action in relation to the channel lines. If prices consistently touch or exceed the upper channel line, it may signal an overbought condition, suggesting a potential reversal. Conversely, prices consistently touching or falling below the lower channel line may indicate an oversold condition and a possible reversal to the upside.

B. Entry and Exit Strategies:

- Breakout Strategies: Traders often look for breakouts beyond the channel lines as potential entry signals. A close above the upper channel line may be interpreted as a bullish signal, while a close below the lower channel line could be considered bearish.

- Pullback Entries: Some traders prefer to enter positions during pullbacks within the channel. Buying near the lower channel line during an uptrend or selling short near the upper channel line during a downtrend are strategies aimed at capturing potential reversals.

III. Keltner Channels in Combination with Other Indicators

A. Confirmation with Oscillators:

- Relative Strength Index (RSI): Combining Keltner Channels with RSI can enhance trading signals. For instance, if prices touch the upper channel line while RSI is in overbought territory, it may strengthen the bearish signal.

- Moving Average Convergence Divergence (MACD): MACD can be used to confirm trend direction. Aligning MACD signals with Keltner Channel breakouts can provide more robust entry and exit points.

B. Support and Resistance Identification:

- Horizontal Support and Resistance: Traders use Keltner Channels in conjunction with traditional support and resistance levels to validate potential reversal points. If a price touches the upper channel line near a historical resistance level, it may reinforce the likelihood of a reversal.

- Fibonacci Retracements: Combining Fibonacci retracement levels with Keltner Channels can help traders identify confluence zones, where multiple technical indicators suggest potential reversals or continuation points.

Conclusion:

The Keltner Channel Trading System is a valuable tool for traders seeking to navigate the complexities of financial markets. By combining trend identification, entry and exit strategies, and confirmation with other indicators, traders can develop a comprehensive approach to decision-making. However, like any trading system, it is essential to thoroughly backtest and understand the strengths and limitations of the Keltner Channel before integrating it into a trading strategy. As with any form of trading, risk management and discipline remain crucial elements for long-term success.