Price action trading is a methodology that focuses on analyzing raw price movements of financial assets without relying on indicators or external data. It’s based on the belief that all necessary information about a security can be found in its price movements and volumes over time. Traders using price action strategies interpret charts, patterns, candlestick formations, and market movements to make trading decisions. Here’s an in-depth exploration of price action strategies:

Principles of Price Action Trading:

- Candlestick Patterns:

- Reading candlestick patterns like doji, hammer, engulfing patterns, etc., to understand market sentiment and potential reversals or continuations.

- Support and Resistance:

- Identifying key support and resistance levels where price tends to react or reverse. These levels provide insights into potential entry and exit points.

- Trend Analysis:

- Recognizing and trading with trends, understanding the structure of higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

- Chart Patterns:

- Analyzing chart patterns like triangles, flags, head and shoulders, etc., which indicate potential breakouts or reversals.

- Price Action Confirmation:

- Waiting for confirmation signals such as multiple candlestick patterns, confluence with other indicators, or volume analysis to increase the reliability of a trade setup.

Strategies in Price Action Trading:

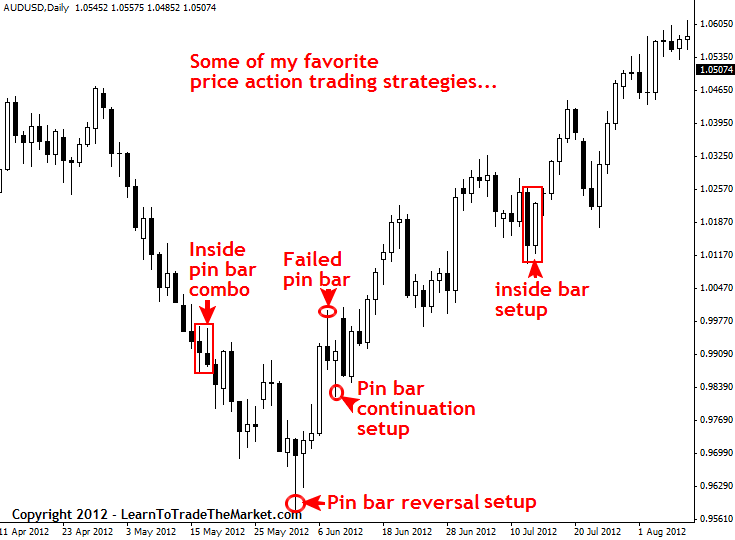

- Pin Bar Strategy:

- Signal: Pin bars are candlesticks with a small body and a long wick (or tail) that indicates rejection of a certain price level.

- Action: Trading based on the assumption that price will move in the opposite direction of the pin bar’s tail.

- Inside Bar Strategy:

- Signal: An inside bar forms when the high and low of a candle are within the high and low of the previous candle.

- Action: Traders anticipate a potential breakout or continuation of the current trend after the inside bar pattern.

- Trendline Breakout Strategy:

- Signal: Drawing trendlines connecting swing highs or lows to identify potential breakout points.

- Action: Trading when the price breaks above or below the trendline, indicating a potential change in trend direction.

- Engulfing Candle Strategy:

- Signal: An engulfing candle pattern occurs when a larger candle completely engulfs the previous smaller candle.

- Action: Traders interpret this as a strong reversal signal if the engulfing candle appears at key support or resistance levels.

Key Considerations in Price Action Trading:

- Patience and Discipline:

- Waiting for high-probability setups and adhering to trading rules is crucial in price action trading.

- Risk Management:

- Implementing stop-loss orders and managing position sizes based on risk tolerance is vital to protect against significant losses.

- Context and Confluence:

- Analyzing price action within the context of broader market conditions and seeking confluence with multiple factors before entering a trade.

- Continuous Learning:

- Price action trading requires continuous learning and practice to refine analysis skills and understand the nuances of market behavior.

Conclusion:

Price action trading relies on understanding and interpreting price movements and patterns without the use of traditional indicators. It emphasizes clear chart analysis, identifying support and resistance levels, chart patterns, and candlestick formations to make informed trading decisions. Traders employing price action strategies need patience, discipline, and a deep understanding of market dynamics to effectively navigate the complexities of financial markets. As with any trading strategy, thorough practice, risk management, and continuous learning are crucial for success.